All Categories

Featured

Table of Contents

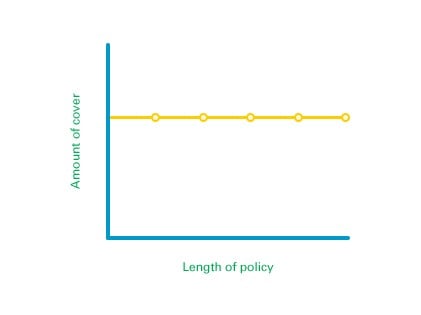

A level term life insurance policy policy can offer you comfort that individuals that rely on you will certainly have a fatality benefit during the years that you are intending to support them. It's a way to assist deal with them in the future, today. A level term life insurance policy (occasionally called degree costs term life insurance policy) policy offers protection for an established variety of years (e.g., 10 or 20 years) while maintaining the costs settlements the same throughout of the policy.

With level term insurance policy, the price of the insurance policy will certainly remain the very same (or potentially lower if rewards are paid) over the term of your plan, usually 10 or two decades. Unlike irreversible life insurance policy, which never ever ends as lengthy as you pay premiums, a level term life insurance policy will finish at some point in the future, generally at the end of the duration of your degree term.

What is Direct Term Life Insurance Meaning? Discover the Facts?

Due to this, lots of people use long-term insurance coverage as a stable financial preparation device that can serve many needs. You might be able to transform some, or all, of your term insurance policy throughout a set period, typically the initial ten years of your policy, without requiring to re-qualify for coverage also if your health has actually altered.

As it does, you might want to add to your insurance policy protection in the future - Life Insurance. As this occurs, you may want to at some point reduce your death advantage or think about converting your term insurance policy to a long-term policy.

So long as you pay your premiums, you can rest easy understanding that your enjoyed ones will obtain a fatality benefit if you die during the term. Many term policies enable you the capability to transform to permanent insurance coverage without having to take an additional health and wellness test. This can allow you to make use of the fringe benefits of an irreversible policy.

Level term life insurance policy is just one of the most convenient paths into life insurance coverage, we'll discuss the advantages and disadvantages to ensure that you can pick a plan to fit your demands. Degree term life insurance coverage is one of the most common and fundamental kind of term life. When you're trying to find short-lived life insurance policy plans, degree term life insurance policy is one path that you can go.

The application process for degree term life insurance policy is commonly extremely straightforward. You'll submit an application that contains general personal details such as your name, age, and so on in addition to a much more in-depth questionnaire regarding your clinical history. Depending upon the policy you're interested in, you may have to take part in a medical checkup procedure.

The brief response is no. A degree term life insurance plan does not develop cash money worth. If you're seeking to have a policy that you have the ability to take out or obtain from, you may explore permanent life insurance policy. Whole life insurance policy plans, for example, let you have the comfort of death advantages and can accrue cash money worth with time, suggesting you'll have much more control over your advantages while you're alive.

Why What Is Level Term Life Insurance Matters

Riders are optional provisions added to your plan that can provide you additional benefits and securities. Anything can take place over the course of your life insurance coverage term, and you desire to be prepared for anything.

This biker gives term life insurance coverage on your youngsters through the ages of 18-25. There are circumstances where these benefits are constructed right into your plan, yet they can likewise be offered as a different enhancement that calls for additional repayment. This rider supplies an added survivor benefit to your beneficiary ought to you die as the result of an accident.

Latest Posts

Funeral Advantage Insurance

Funeral Cover Plans

Is Burial Insurance The Same As Life Insurance