All Categories

Featured

Table of Contents

Home mortgage life insurance policy supplies near-universal coverage with minimal underwriting. There is typically no medical exam or blood example called for and can be an important insurance coverage choice for any type of house owner with major pre-existing medical problems which, would avoid them from purchasing standard life insurance policy. Various other advantages include: With a home loan life insurance plan in place, beneficiaries won't have to worry or wonder what could take place to the family home.

With the mortgage settled, the family members will constantly have an area to live, given they can manage the real estate tax and insurance policy every year. cmhc insurance in force.

There are a couple of various sorts of mortgage defense insurance, these consist of:: as you pay more off your mortgage, the amount that the policy covers minimizes in line with the exceptional equilibrium of your mortgage. It is one of the most common and the most affordable kind of mortgage protection - is mortgage insurance the same as home insurance.: the amount guaranteed and the costs you pay remains degree

This will settle the mortgage and any type of continuing to be balance will go to your estate.: if you want to, you can include significant disease cover to your home loan defense policy. This means your home mortgage will certainly be removed not just if you pass away, yet additionally if you are diagnosed with a major ailment that is covered by your policy.

Private Mortgage Insurance Companies Ratings

In addition, if there is a balance continuing to be after the mortgage is cleared, this will certainly most likely to your estate. If you change your mortgage, there are a number of points to take into consideration, depending upon whether you are topping up or prolonging your home mortgage, changing, or paying the mortgage off early. If you are covering up your home loan, you require to make sure that your plan meets the new value of your mortgage.

Compare the prices and advantages of both alternatives (mortgage cover for death). It might be less expensive to keep your original home loan defense policy and after that acquire a 2nd plan for the top-up quantity. Whether you are covering up your mortgage or prolonging the term and require to get a new policy, you might discover that your costs is greater than the last time you obtained cover

Buy Ppi Insurance

When switching your mortgage, you can designate your home mortgage security to the new lending institution. The premium and degree of cover will coincide as before if the quantity you obtain, and the regard to your home loan does not transform. If you have a plan with your lending institution's team plan, your lender will certainly cancel the policy when you change your home mortgage.

In California, home loan defense insurance covers the entire impressive balance of your financing. The fatality advantage is an amount equivalent to the equilibrium of your home loan at the time of your death.

Do You Need Life Insurance To Buy A House

It's important to understand that the survivor benefit is provided straight to your creditor, not your liked ones. This ensures that the continuing to be financial obligation is paid in full which your loved ones are saved the economic stress. Mortgage protection insurance coverage can likewise offer momentary insurance coverage if you end up being handicapped for a prolonged period (generally 6 months to a year).

There are several benefits to obtaining a home mortgage protection insurance coverage policy in California. Some of the top advantages include: Ensured approval: Also if you're in inadequate health and wellness or work in a dangerous occupation, there is ensured authorization without any medical examinations or lab tests. The same isn't true forever insurance.

Handicap defense: As specified over, some MPI policies make a couple of home mortgage repayments if you come to be impaired and can not generate the very same revenue you were accustomed to. It is very important to note that MPI, PMI, and MIP are all various kinds of insurance policy. Home loan protection insurance coverage (MPI) is designed to settle a home loan in case of your fatality.

Mortgage Loan Policy

You can even apply online in minutes and have your plan in place within the very same day. To find out more about getting MPI coverage for your mortgage, get in touch with Pronto Insurance policy today! Our educated agents are below to address any type of concerns you might have and give more aid.

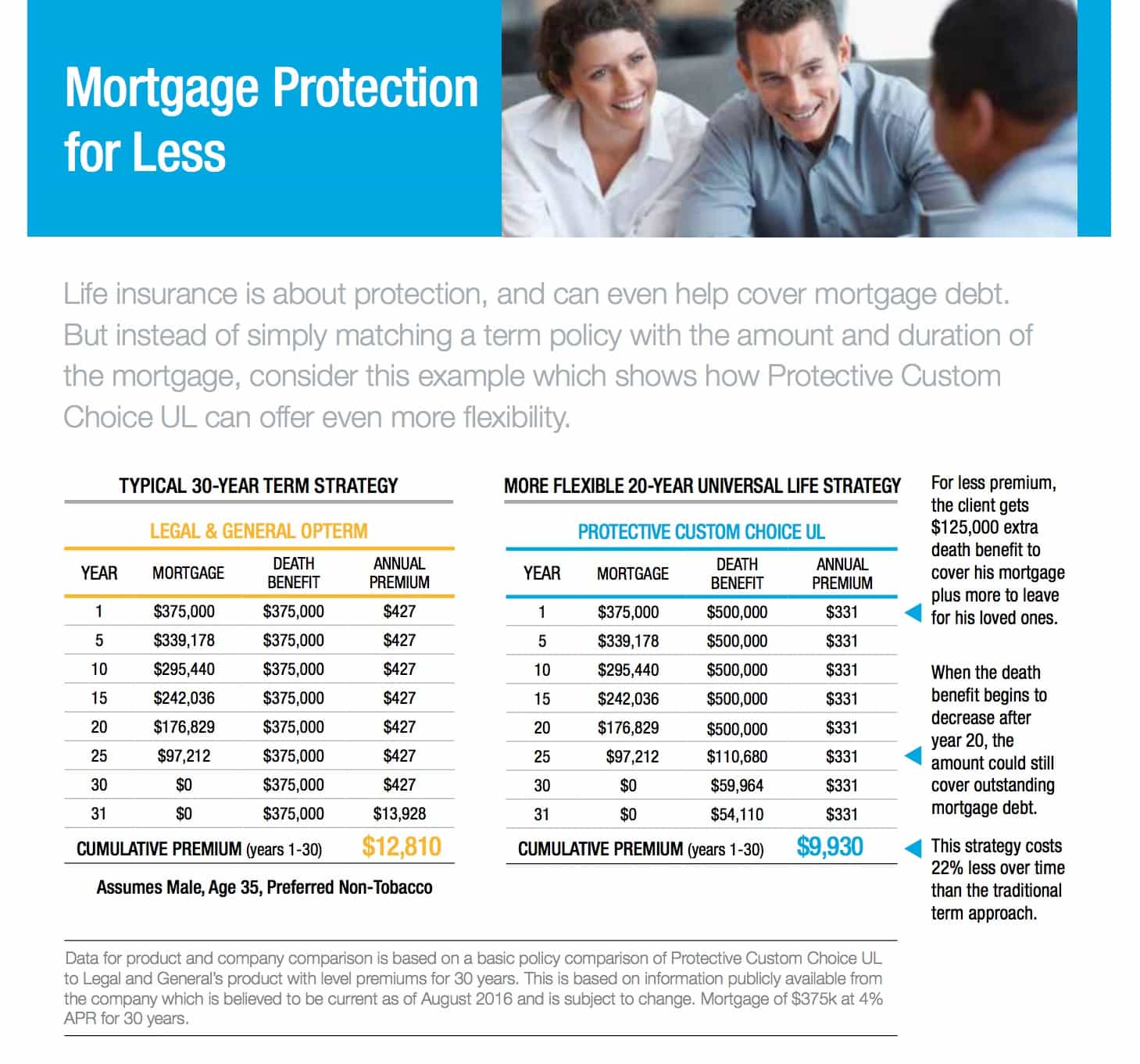

It is advisable to contrast quotes from various insurers to discover the most effective price and coverage for your demands. MPI provides several benefits, such as tranquility of mind and streamlined certification processes. Nonetheless, it has some limitations. The survivor benefit is directly paid to the lender, which restricts adaptability. In addition, the advantage amount lowers in time, and MPI can be a lot more expensive than standard term life insurance policy plans.

Affordable Mortgage Protection

Enter basic information regarding on your own and your home mortgage, and we'll compare rates from different insurance companies. We'll additionally show you exactly how much protection you need to safeguard your mortgage. So get started today and provide on your own and your family the assurance that includes recognizing you're safeguarded. At The Annuity Specialist, we recognize property owners' core issue: guaranteeing their household can keep their home in the occasion of their death.

The major benefit below is quality and confidence in your decision, understanding you have a plan that fits your demands. As soon as you authorize the strategy, we'll handle all the documents and arrangement, guaranteeing a smooth implementation procedure. The positive outcome is the assurance that includes recognizing your household is secured and your home is safe and secure, regardless of what happens.

Professional Guidance: Assistance from seasoned specialists in insurance policy and annuities. Hassle-Free Setup: We take care of all the documentation and implementation. Affordable Solutions: Finding the very best coverage at the cheapest possible cost.: MPI particularly covers your mortgage, giving an additional layer of protection.: We function to locate the most cost-efficient options customized to your budget.

They can give information on the coverage and advantages that you have. Typically, a healthy and balanced individual can expect to pay around $50 to $100 per month for home mortgage life insurance policy. It's advised to get a tailored home loan life insurance coverage quote to obtain an accurate quote based on private situations.

Latest Posts

Funeral Advantage Insurance

Funeral Cover Plans

Is Burial Insurance The Same As Life Insurance