All Categories

Featured

Table of Contents

Mortgage life insurance policy supplies near-universal coverage with very little underwriting. There is frequently no medical exam or blood example called for and can be a valuable insurance policy option for any house owner with severe preexisting medical problems which, would prevent them from acquiring traditional life insurance. Various other advantages include: With a home loan life insurance coverage plan in place, heirs will not need to worry or question what might take place to the family home.

With the home mortgage paid off, the family members will always belong to live, offered they can pay for the real estate tax and insurance yearly. should you get mortgage protection insurance.

There are a few various sorts of home loan protection insurance coverage, these consist of:: as you pay even more off your home mortgage, the amount that the policy covers minimizes in line with the impressive balance of your home loan. It is the most common and the most affordable type of home loan protection - home mortgage protection plan.: the quantity guaranteed and the premium you pay stays degree

This will repay the mortgage and any staying equilibrium will most likely to your estate.: if you wish to, you can include severe disease cover to your home mortgage protection policy. This means your home mortgage will be gotten rid of not just if you die, yet also if you are identified with a major ailment that is covered by your plan.

Globe Life Home Mortgage Group Reviews

Furthermore, if there is a balance continuing to be after the home loan is cleared, this will most likely to your estate. If you transform your home mortgage, there are numerous things to take into consideration, relying on whether you are topping up or prolonging your home mortgage, changing, or paying the home loan off early. If you are covering up your home mortgage, you need to see to it that your policy fulfills the new worth of your home loan.

Compare the costs and advantages of both alternatives (why do you need mortgage insurance). It might be less expensive to maintain your original mortgage security policy and after that acquire a 2nd plan for the top-up amount. Whether you are topping up your home loan or extending the term and require to obtain a new policy, you may locate that your premium is greater than the last time you took out cover

Mortgage Life And Disability Insurance Calculator

When changing your home mortgage, you can designate your home mortgage defense to the brand-new loan provider. The costs and degree of cover will coincide as before if the amount you obtain, and the regard to your mortgage does not change. If you have a policy via your lender's group system, your lending institution will certainly terminate the plan when you switch your mortgage.

In California, home loan security insurance policy covers the whole outstanding equilibrium of your funding. The death benefit is an amount equivalent to the equilibrium of your home mortgage at the time of your passing away.

When Do You Have To Buy Mortgage Insurance

It's crucial to understand that the death benefit is given directly to your creditor, not your enjoyed ones. This ensures that the continuing to be financial obligation is paid in full and that your enjoyed ones are spared the monetary stress. Home mortgage protection insurance can additionally supply short-term protection if you end up being handicapped for a prolonged period (normally six months to a year).

There are many advantages to getting a home mortgage security insurance coverage policy in California. A few of the top benefits consist of: Guaranteed approval: Also if you remain in poor wellness or operate in an unsafe profession, there is guaranteed approval without medical examinations or laboratory tests. The same isn't real for life insurance coverage.

Special needs security: As specified over, some MPI policies make a couple of home mortgage settlements if you become disabled and can not generate the very same income you were accustomed to. It is necessary to keep in mind that MPI, PMI, and MIP are all various types of insurance coverage. Home mortgage protection insurance policy (MPI) is created to repay a mortgage in situation of your death.

What Is Mortgage Life And Disability Insurance

You can also apply online in minutes and have your policy in location within the very same day. To find out more concerning obtaining MPI coverage for your mortgage, get in touch with Pronto Insurance today! Our educated representatives are right here to respond to any kind of inquiries you might have and provide additional support.

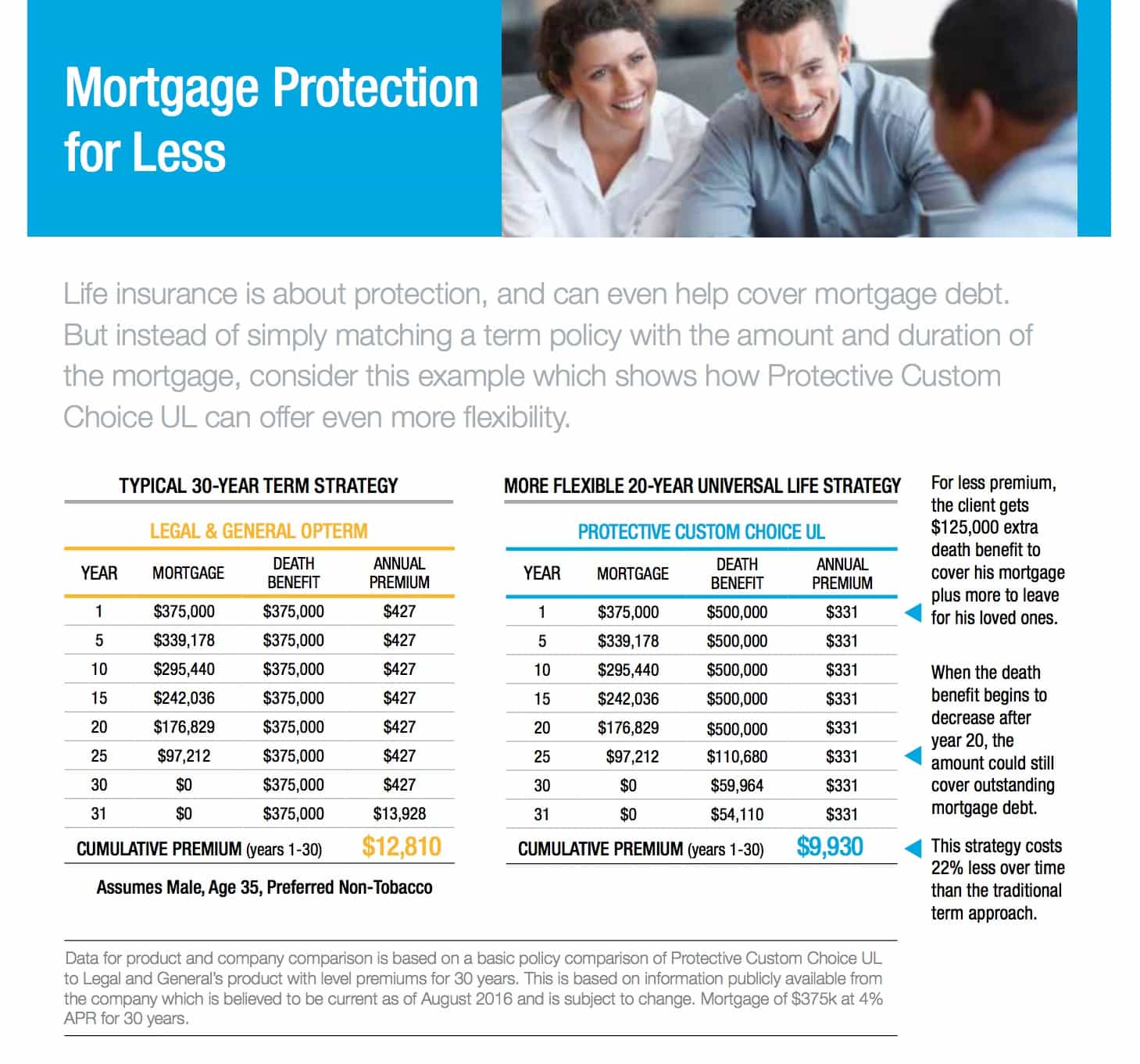

MPI provides numerous advantages, such as peace of mind and simplified qualification procedures. The death benefit is straight paid to the lending institution, which restricts flexibility - how does home insurance work with a mortgage. Additionally, the benefit amount decreases over time, and MPI can be much more pricey than basic term life insurance policies.

Mortgage Protection Life

Get in standard details about yourself and your mortgage, and we'll contrast rates from various insurance firms. We'll also reveal you just how much coverage you require to protect your mortgage.

The main benefit right here is clarity and confidence in your decision, knowing you have a plan that fits your demands. As soon as you approve the plan, we'll deal with all the documents and configuration, ensuring a smooth execution process. The favorable outcome is the comfort that features knowing your family is shielded and your home is secure, no matter what happens.

Expert Advice: Guidance from knowledgeable specialists in insurance and annuities. Hassle-Free Setup: We manage all the documentation and execution. Cost-Effective Solutions: Locating the very best protection at the most affordable feasible cost.: MPI especially covers your home loan, providing an additional layer of protection.: We work to find one of the most cost-effective remedies tailored to your budget.

They can offer information on the protection and advantages that you have. Usually, a healthy person can expect to pay around $50 to $100 per month for mortgage life insurance policy. It's advised to obtain a personalized mortgage life insurance coverage quote to get a precise price quote based on private scenarios.

Latest Posts

Funeral Advantage Insurance

Funeral Cover Plans

Is Burial Insurance The Same As Life Insurance